The Challenges of Carbon Capture at the San Juan Generating Station

The Challenges of Carbon Capture at the San Juan Generating Station

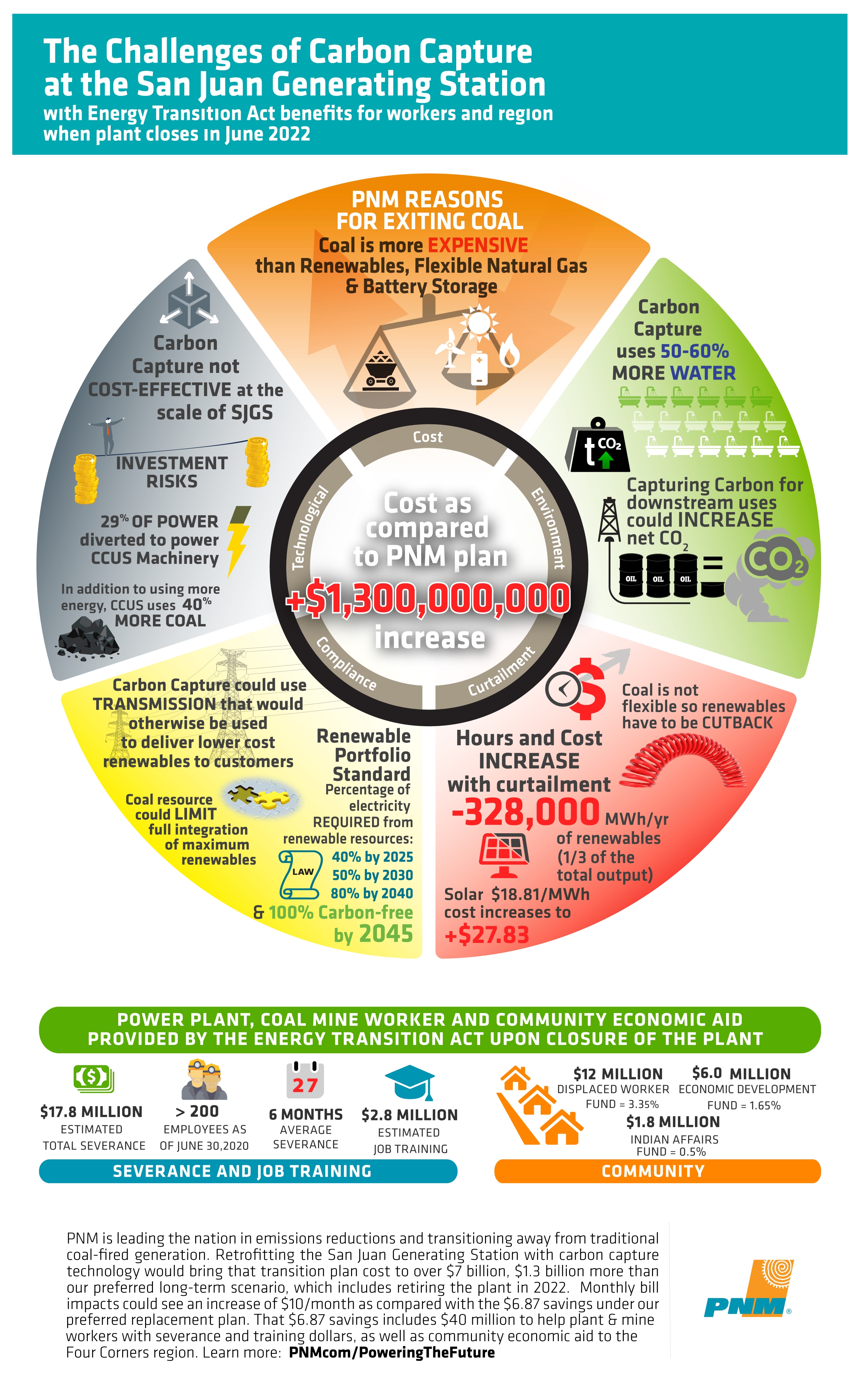

We have created the below infographic to help explain some of the challenges for PNM to move forward with a carbon capture project. These challenges also make a Purchase Power Agreement (PPA) from a third party from a “Carbon Captured San Juan Generating Station” exceedingly difficult and significantly more expensive for customers.

The Internal Revenue Service (IRS) on February 19, 2012 issued its long-awaited guidance aimed at helping businesses take advantage of a tax credit for those using use equipment to capture carbon from the atmosphere. Carbon capture technology, which helps remove carbon from the atmosphere, is still emerging. One way it’s currently used is in oil recovery, making it controversial among those who oppose fossil fuel extraction.

The IRS section 45Q tax credit incentivizes the use of this technology by allowing a tax credit for qualified carbon oxide (CO2) captured at facilities whose construction starts before 2024. On Wednesday, the IRS provided further guidance on the necessary activities to demonstrate that construction has started and expanded the time allowed for completion of these projects from four to now six years, representing the increased complexity and uncertainty of this technology.

The IRS guidelines are mostly as anticipated and consistent with our assumptions used in the previously completed comparative analysis. After reviewing the guidelines, we still calculate the San Juan Carbon Capture project to be $1.3 Billion more expensive than our preferred scenario.

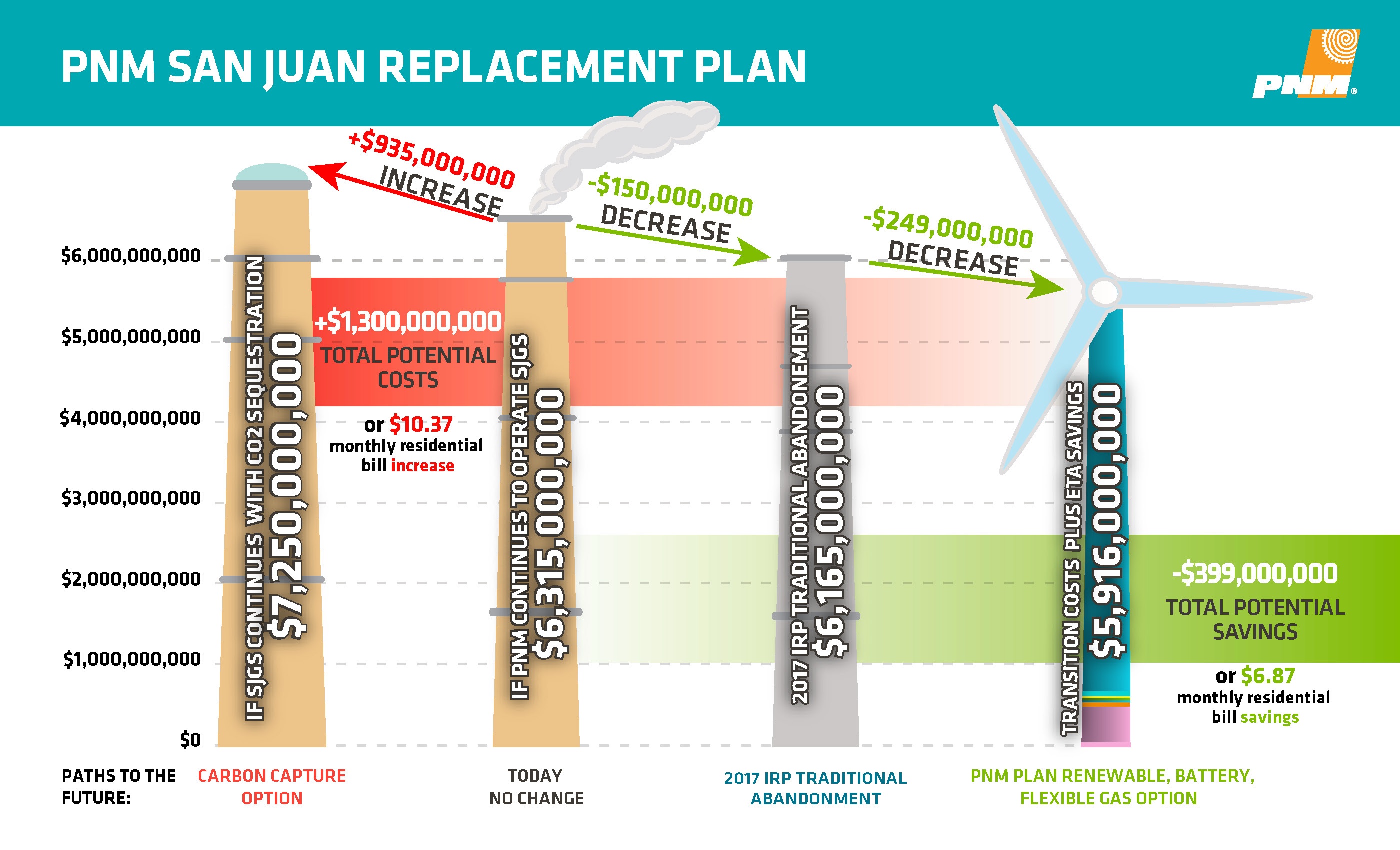

The above infographic shows the financial analysis starting with the decision by PNM to exit Coal in its integrated resource plan (IRP) back in 2017. At that time, PNM demonstrates that exiting coal would save customers. Utilizing the new tools provided in the Energy Transition Act (ETA), in which PNM shareholders forgo over $100 million in future profits, and the remaining debt is refinanced at a lower interest rate, it brings the total from exiting coal to a savings of $399 million. Our replacement plan includes solar, wind, flexible natural gas, and battery storage. Retrofitting the San Juan Generating Station with carbon capture technology would cost an additional $1.3 billion more than our preferred long-term scenario, which includes retiring the plant in 2022. Monthly bill impacts for the average residential customer could see an increase of $10/month as compared with the $6.87/month savings under our preferred replacement plan.

“We do not doubt that carbon capture works in a laboratory setting. Our challenges are to make it work cost-effectively at the scale of the San Juan Generating Station. These challenges become even more difficult when you are working to reach the statutory mandate of 80% renewables with coal resources that limit the full use of renewables. We understand the benefit of this technology could potentially provide to help fight climate change, but PNM has an obligation to its customers to provide reliable, affordable and environmentally responsible energy. PNM continues to see significant concerns that could expose PNM customers to significant costs and potential system reliability concerns with this technology. Nothing in the guidelines issued from the IRS on Wednesday changes our financial analysis. ” Thomas Fallgren, Vice President of Generation, PNM.